8 Money Habits of the Successfully Rich: Insights from “The Millionaire Next Door”

I’ve always been curious about the money habits of successful, wealthy people. Often, these habits are what lead them to become extremely rich. We need specific habits to help us succeed and build our wealth to achieve our financial goals and we can adopt some of these effective practices by learning from those who are already successful.

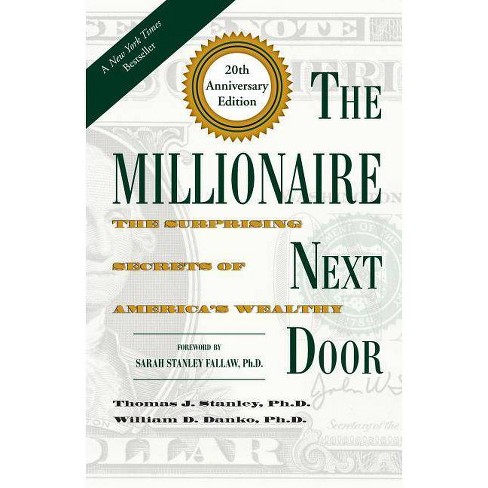

One of my favorite books is “The Millionaire Next Door,” by Dr. Thomas J. Stanley and Dr. William D. Danko. This book is based on extensive research they conducted on millionaires over many years. They spoke with more than 500 millionaires in personal interviews, and their findings revealed many surprising habits among these wealthy individuals.

Many of us judge someone’s wealth based on their flashy cars or expensive homes, but this book changed my perspective. It helped me understand what true wealth looks like and how it operates. We often mistakenly link wealth to hyperconsumerism, influenced by how it’s portrayed in movies and television. The research in this book offers valuable insights and lessons.

Here are the 8 key habits I took away from reading it.

1. Live Below Our Means

We often see rich people living glamorous lives in Hollywood, showcasing their wealth on social media, television, and movies. They flaunt designer bags, luxurious mansions, and fancy cars. However, the book “The Millionaire Next Door” reveals a different story. The typical American millionaire doesn’t live that way. Instead, these millionaires often practice what is known as the “Art of Stealth Wealth.” They lead modest lifestyles and usually live in neighborhoods filled with middle-class families, blending in without us even noticing.

Dr. Stanley and Dr. Danko wrote this book to challenge the myths that mass media creates about millionaires. Contrary to popular belief, they show us that these millionaires don’t necessarily live extravagantly like we see on reality TV or social media.

A crucial habit we can adopt to achieve financial freedom is living below our means. The research in the book indicates that millionaires are often incredibly frugal. This intentional approach to spending has helped many of them build wealth. One example in the book is a couple who are both engineers. They earn good incomes but ultimately choose to live on one salary and save the other. They even directed every raise they got into their savings and investments.

Millionaires’ habits often align with the principles of the FIRE (Financial Independence, Retire Early) movement. They prioritize financial freedom and independence over showing off their wealth or buying flashy luxury items. Instead of bragging about their possessions, they allow their bank accounts and assets to speak for themselves.

2. Save and Avoid Debt

In the book, Dr. Stanley and Dr. Danko introduce us to two types of people: the UAWs, or “Under Accumulators of Wealth,” and the PAWs, or “Prodigious Accumulators of Wealth.” UAWs are people who have a low net worth compared to their income. For example, we might think of a 45-year-old doctor who earns a high salary, like $250,000 per year, but has saved much less than expected. The authors provide a formula to determine the amount of wealth we should have based on age and salary.

The book “The Millionaire Next Door” shares this formula for calculating our expected net worth:

- First, we multiply our age by our taxable annual income.

- Then, we divide that amount by 10.

- Finally, we subtract any inherited wealth.

Let’s take the doctor’s situation as an example: if we multiply 45 (their age) by $250,000 (their salary), we get $11,250,000. When we divide that by 10, we find that their expected net worth should be $1.125 million. If the doctor’s actual net worth is below this amount, they would be classified as a UAW. On the other hand, if their net worth is above this figure, they are considered to be accumulating wealth “prodigiously,” making them PAWs.

We can use this formula to evaluate our net worth and saving habits. A wealthy individual, or PAW, typically has a high net worth because of their savings, substantial income, and low Debt. In fact, PAWs often have two to four times the expected net worth compared to UAWs.

3. Create a Budget, Track Expenses

“In our latest national survey of millionaires, we found that for every 100 millionaires who don’t budget, there are about 120 that do…. “These people invest a minimum of 15% of their annual realized income before they pay the sellers of their food, clothes, home, credit, and the like..”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

In the book, and after interviewing hundreds of millionaires, Dr. Stanley and Dr. Danko explain that most follow a budget to track their spending habits closely. They point out, “In our latest national survey of millionaires, we found that for every 100 millionaires who don’t budget, there are about 120 who do. These people invest at least 15% of their annual realized income before paying for necessities like food, clothes, and housing.”

This habit of budgeting and prioritizing savings is common among millionaires. They strongly believe in the “pay yourself first” strategy, which I discussed in my post based on the book “The Richest Man in Babylon.” The research highlights that most wealthy millionaires adhere to a strict budget, which has been essential in building their wealth.

Stanley emphasizes that we need a new perspective on how regular millionaires operate. They tend to value financial freedom and independence more than a flashy lifestyle filled with luxury. These individuals are budget-conscious, savvy investors, and self-made, meaning they earned their wealth rather than inheriting it.

According to the study, over 62% of “millionaires next door” have a household budget that they stick to and regularly review all their expenses. As a result, they know exactly how much money is coming in, how much they are saving, and how much they are spending. On the other hand, many under-accumulators of wealth (UAW) don’t budget and often overlook the actual costs of their extravagant lifestyles.

4. Choose the Right Profession and Identify Opportunities

“The Millionaire Next Door” revealed that more than 80% of millionaires are self-made. The essential ingredient to becoming a successful millionaire is finding the right profession and identifying opportunities within that area for specialization.

Most millionaires worked to own their businesses. Their businesses may be something other than what we consider very exciting. For example, the business may provide something important to society or a vital service, such as waste disposal or plumbing services. These businesses aren’t flashy, but they provide a way for these millionaires to do a business that could create an inflow of profit.

“I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you.”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

One important point we can take away from the book is that we don’t need to be entrepreneurs to create and build wealth. Many self-made millionaires have succeeded by focusing on a specific profession and developing the necessary skills and expertise. By honing our abilities in areas that are in high demand, we position ourselves to reach the upper echelons of our chosen careers. This path allows us to achieve financial success without starting our businesses.

Moreover, these millionaires demonstrate that having a solid financial discipline is just as crucial as choosing the right profession. We can leverage our skills and the opportunities available in our fields to increase our earning potential. When we do this effectively, we are setting ourselves up for personal success and creating a foundation for generational wealth. This thinking means our financial gains can benefit future generations, allowing them to thrive and succeed.

5. Avoid “Looking” Rich

We’ve recently discussed the concept of Stealth Wealth. According to Dr. Stanley and Dr. Danko’s research in their book The Millionaire Next Door, real millionaires often don’t seem rich at all. They tend to avoid showing off their wealth.

“Many people who live in expensive homes and drive luxury cars do not actually have much wealth. Interestingly, we found that many wealthy individuals don’t live in upscale neighborhoods.”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

We learn that the millionaire next door often doesn’t drive high-end luxury cars. The study reveals most millionaires opt for used vehicles that are several years old and typically don’t lease or finance them. The top car brands among these millionaires are Toyota, Honda, and Ford; surprisingly, BMW is fifth on the list. Only 25% drive a current-year model, 37% buy used vehicles, and 80% prefer buying rather than leasing.

“It’s easier to accumulate wealth if we don’t live in a high-status neighborhood.”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

The millionaire next door usually resides in a relatively modest home within a good neighborhood. They tend to stay in their homes for nearly twenty years and often own them outright. Additionally, they choose to live among middle-class families, keeping their wealth mostly under wraps.

When it comes to luxury goods, since we want to blend in with the middle class, we are less likely to own high-status items usually associated with the rich. Instead, we practice the art of stealth wealth, living modestly and reinvesting the remainder of our money back into our businesses while accumulating assets.

6. Invest in Our Education

The millionaires described in “The Millionaire Next Door” understand how important education is for improving social status and opening doors for themselves and their children. They are willing to pay for high-quality education without cutting corners. 88% of the millionaires studied had college degrees, and 38% had advanced degrees.

When planning for education, many of these millionaires set aside funds for their children’s and grandchildren’s schooling, ensuring they have the resources needed for college and beyond. Dr. Stanley and Dr. Danko’s research revealed that these millionaires view education as a key to moving up the social ladder.

As Dr. Thomas J. Stanley notes, “Multiply your age by your pre-tax annual household income from all sources, excluding inheritances. Divide that number by ten. This figure, minus any inherited wealth, represents what your net worth should be.”

Moreover, these millionaires don’t stop learning after college. They continue to educate themselves throughout their careers to stay updated in their fields. They strive to be experts and genuinely love learning new things, finding joy in the educational process itself.

7. Invest and Plan for the Long-term

In the book, the author highlights the study of wealthy people and how they accumulate assets by making wise investments. This strategy typically focuses on long-term investments in a diverse range of stocks, real estate, and businesses they own.

Regarding stocks, these millionaires adopted a “buy and hold” strategy, keeping their investments for many years. Their portfolios revealed that they gradually increased their stock holdings over time, holding onto their investments for nearly two decades to allow their value to grow through compounding.

Furthermore, careful financial planning was crucial for their success. Of 292 millionaires surveyed by researchers Thomas J. Stanley and William D. Danko, 192 took the time to plan for their financial futures. Interestingly, the study found that heirs of wealthy families were less likely to hire financial planners or to think about their long-term financial plans. The lesson highlights an important point: systematic planning is essential for building wealth.

The strategies of these millionaires emphasize that accumulating wealth requires patience, financial discipline, and a focus on long-term investments.

“The foundation stone of wealth accumulation is defense, and this defense should be anchored by budgeting and planning.”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

8. Marry the Right Partner

“Most people will never become wealthy in one generation if they are married to people who are wasteful. A couple cannot accumulate wealth if one of its members is a hyperconsumer.”

— Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

In “The Millionaire Next Door,” it’s noted that many millionaires have been married to the same person for most of their lives. This lesson shows that marriage can significantly impact wealth, especially when you choose the right partner with whom you can build a financial future.

Many people lose their wealth because of failed marriages or divorces. Couples who stay together tend to keep and even grow their wealth. However, marriage isn’t enough; the couple’s lifestyle and mindset must also align. It’s important to marry someone who shares similar values and goals.

For example, millionaires often choose spouses with frugal habits like their own. These couples prioritize building wealth and maintaining a successful marriage rather than living extravagantly. They frequently find ways to save money together, such as using coupons for groceries, even when they have significant wealth.

This frugality is an integral part of financial planning. Just like successful businesses manage their expenses closely, so should families. Having a spouse who values saving money helps protect against economic problems.

The key takeaway is that sharing common financial beliefs with your partner is crucial. Couples with similar views about money and saving are much more likely to accumulate wealth together.